what is Form 16 ?

Form 16 is Issued by the Employer of an Individual. It is basically the proof of the TDS Deducted from your Salary and Paid to the Income Tax Department. Form 16 is Usually used for Filing the Income Tax Return of an employee. An Individual can have multiple Form 16 if he has been employed in different organisations in a financial year.

Form 16 is divided into two parts Part A and Part B.

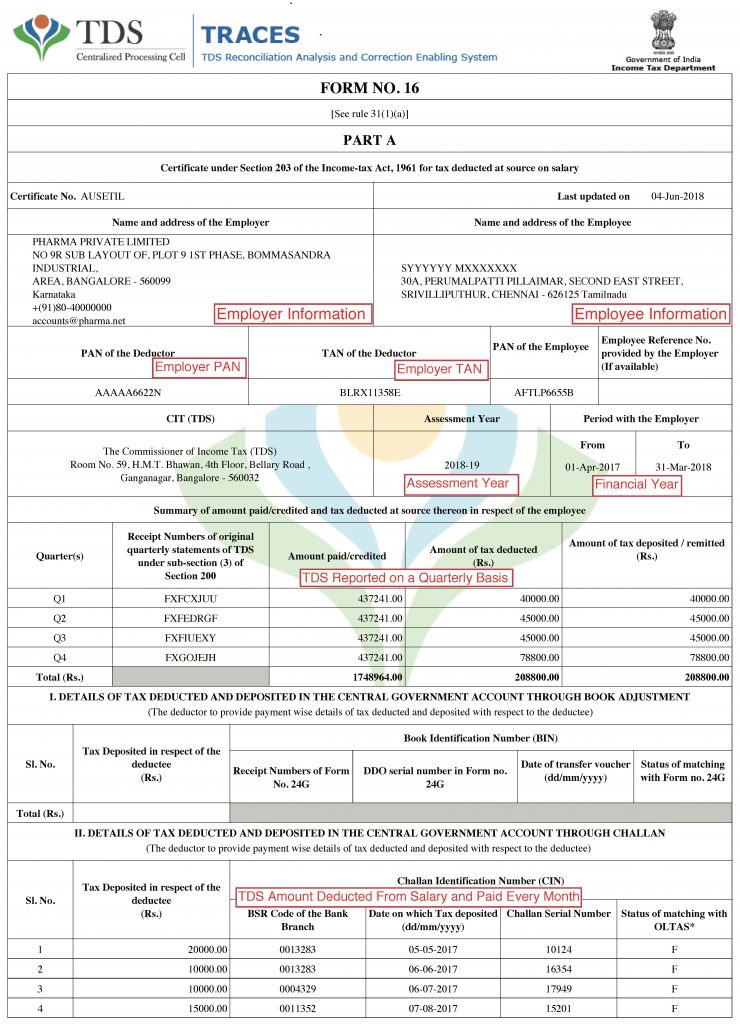

Part A of Form 16 Consists of Information Related to the Employee, Employer Information, Tax Deducted and deposited on a Quarterly basis.

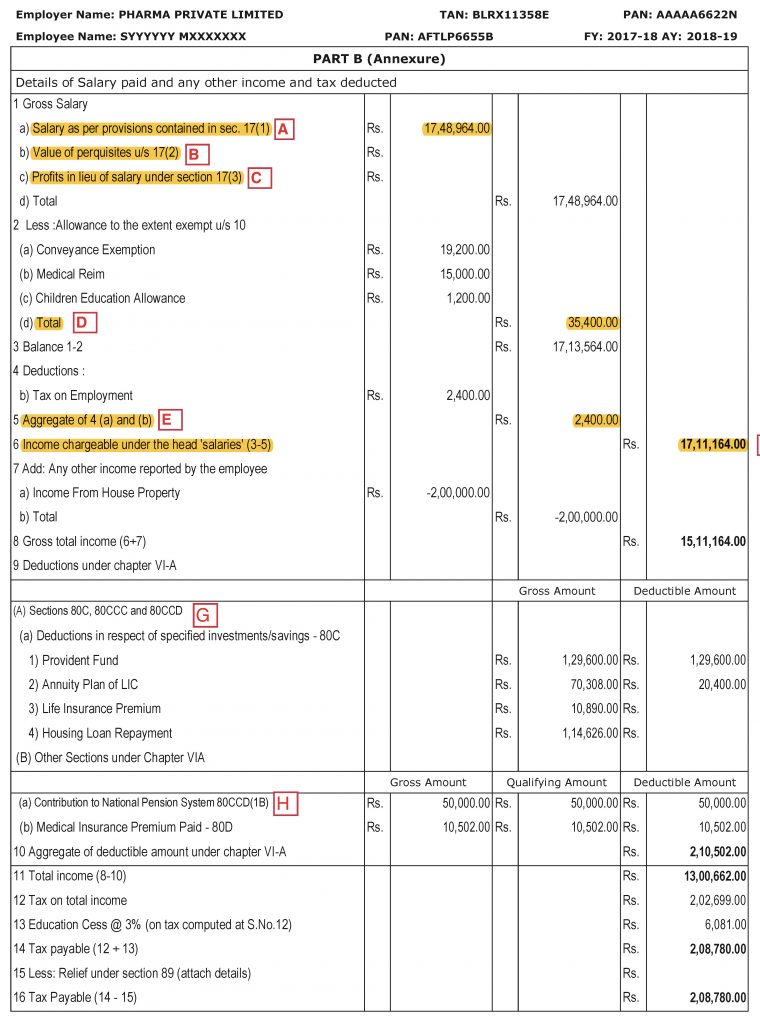

Part B of Form 16 Consists of Information related to Income Information, Deductions, Taxes Paid of an Employee which is used in Filing of your Income Tax Returns.

Part A of Form 16

Form 16 A is Explained Clearly with the Image Illustrations as given Below.

Employer Information: This Section Contains the Company Legal Name, Registered Address, and Contact Information.

Employee Information: This Section Contains the Name and Address Information of an Employee.

Note: While Filing the ITR Form the name entered should match the Income Tax Department Database.

Form 16 has your Name in this Order FIRST_NAME MIDDLE_NAME LAST_NAME

Incase there in only one Name mentioned then Fill Only the LAST Name in the ITR Form.

Incase there is Two Names with Space then Fill the First and Last Name in the ITR Form.

PAN Of Employer: PAN of an Employer is Required to be filled in the ITR Form.

TAN of the Deductor: This is your TAN Number of the Employer and is Required to be filled in the ITR Form.

Assessment Year: Ensure the Form 16 is of the correct Assessment Year. Assessment Year is the Year in Which you File the returns for the Previous Financial Year.

Example : If Assessment Year is 2018-2019 then Financial Year is 2017-2018.

Financial Year: Ensure the Form 16 is of the correct Financial Year.

TDS Reported on Quarterly Basis: Here you can Cross verify if all the Tax Deducted by your Company on a Quarterly Basis.

TDS Deducted From Salary Every Month: Here you can check if the Tax Deducted on your salary is Deposited to the Government on a Monthly Basis.

Part B of Form 16

Form 16 B Contains Information Related to Gross Salary, Income Exempted from Income Tax, Section 80 C Deductions, Income From house property, Your Total Income and Tax Payable.

Note: While Filing the Income Tax Returns your Tax Payable, Income, Section 80C Deduction all can change due to various reasons.

- Incase a Tax Payer has multiple Form 16.

- Incase a Tax Payer has other sources of Income From Freelancing, Fixed Deposits etc…

- Incase a tax Payer has not declared Income from his House Property.

- Incase a Tax Payer has not declared his Section 80 C Deductions to the company, etc…

FundsInn.com helps you make your Investments in Section 80 C and helps you File your Income tax for Free.

For Further Queries Related to tax filing Contact our Support at 080 – 41244426

YOU MAY ALSO LIKE

Everything That You Need to Know About Income from House Property Your home, your office, or even a shop can be your house property. According to the Income Tax Act, there is no differentiation between a commercial and a residential property. Every property is taxed under the single head of ‘income from house property.’ Here is all you need to…Read More

Income Tax Slabs are differentiated based on the Tax Status, Gender and Age of Individual Tax Payer Income Tax Slab Rates for an Individual Upto the Age of 59 Years for both Male and Female or an HUF (Hindu Undivided Family) in Financial Year (2019-2020) Assessment Year (2020-2021). Taxable Income Range Tax Rate in % 0- 2,50,000 NIL 2,50,001 –…Read More

Which is Better ELSS or PPF? Savings form an important part of our life. It is important that you not only save but also invest the savings into the right products. It is essential to have knowledge of different products when making an investment decision. Equity Linked Savings Scheme (ELSS) and Public Provident Fund (PPF) are two products, which are…Read More